Test Automation in Financial Services With ACCELQ

Test automation is crucial in financial services as it ensures key critical apps and systems' reliability, accuracy, and security. However, the industry is uniquely structured, which makes automation testing a huge challenge.

Challenges of automation testing in financial services

The complex nature of financial services applications, the need for comprehensive testing, and strict compliance requirements make automation testing challenging.

- Financial services workflows are complex. They involve processing large financial transactions, including withdrawals, deposits, transfers, etc.

- Organizations in this industry are heavily regulated. They must comply with constantly changing rules and regulations.

- Financial services organizations also need to enable top-notch customer service.

- They need to stay up-to-date with the latest technology trends and innovations.

As financial services go digital, the apps supporting them have to be reliable and secure. For this to happen, it is important to test the applications thoroughly. Therefore, the use of test automation in financial services becomes essential. However, it is easier said than done. The unique nature of the industry makes automation testing in financial services challenging.

Let’s look at the top concerns of automation testing in financial services:

Complex business processes

Financial services revolve around complex procedures, including updating customer data, KYC validations, and accounting reconciliations. Given the ever-changing nature of data in these systems, testing in financial services becomes essential to enhance the speed and maintain the accuracy of core financial services operations.

Sensitive data

Financial services apps and systems hold large amounts of extremely sensitive financial and customer information. Hackers constantly look for vulnerabilities in these apps. Therefore, testing teams must craft strategies and adopt automation testing tools to safeguard this sensitive data.

Strict compliance requirements

In today’s digital world, navigating complicated financial regulations and compliance rules doesn’t come easy. Since regulators do not permit any kind of negligence, testing teams must constantly stay abreast of evolving requirements while building their test suites.

Legacy integration

Financial services companies rely on a huge web of legacy systems. These systems lack modern APIs and offer limited documentation. This makes it difficult for testers to understand the system's architecture, dependencies, and business rules. Testers must develop test cases that cater to these unique specifications and conditions during automation testing. They must also prioritize test cases and adopt the right testing framework to reduce test automation execution times.

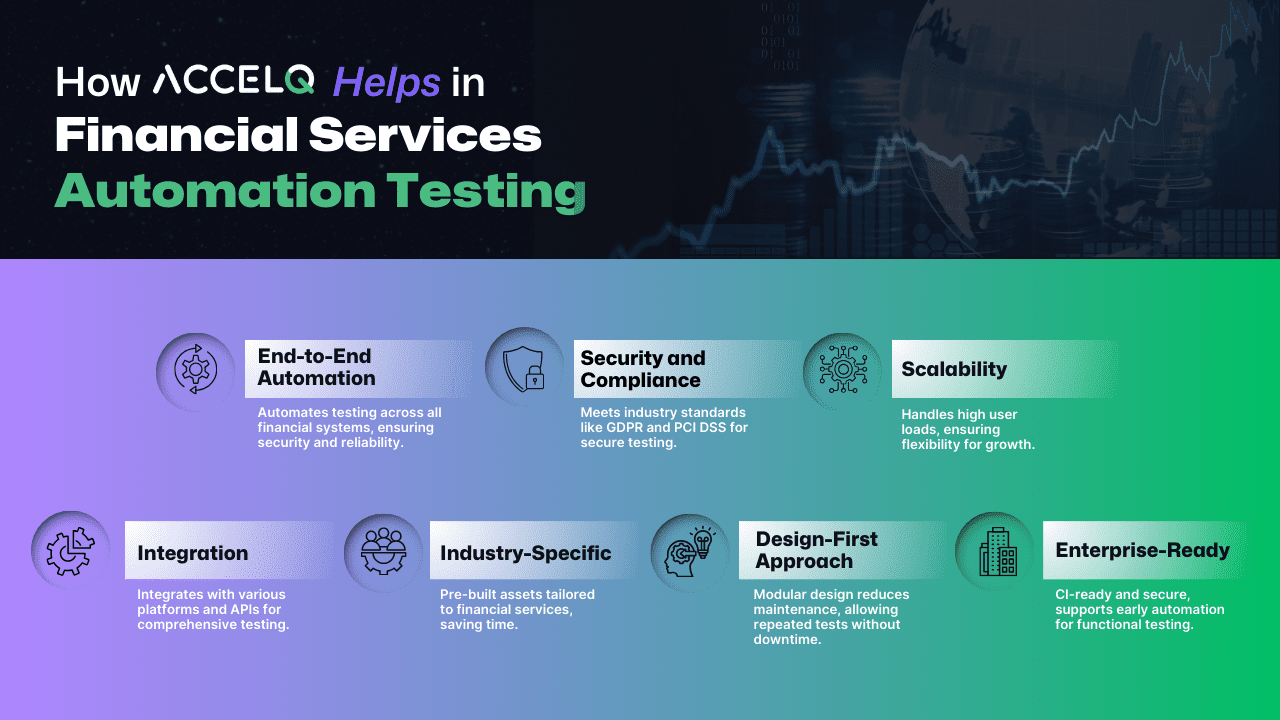

How ACCELQ helps in financial services automation testing

Given the test automation in financial services challenges, adopting a modern, intelligent, and robust solution is pressing. ACCLEQ’s codeless AI automation and quality assurance platform exclusively aligns with the needs of financial services companies. Let’s look at why ACCELQ is the leading financial services testing solution:

End-to-end automation

Complex and multifaceted financial services applications need continuous and comprehensive testing. ACCELQ automates the testing of the complete financial services application ecosystem. Right from legacy green screens to desktop thick clients, modern web to microservices API and mobile apps. Such end-to-end automation accelerates the testing lifecycle and ensures financial services applications work securely, reliably, and consistently.

Security and Compliance

The Financial Services sector deals with extremely sensitive data, including personal and financial information. ACCELQ’s codeless test automation platform complies with industry security standards, including GDPR, PCI DSS, and more. With features built to handle data securely, companies can ensure effective testing in financial services.

Scalability

Testers must ensure they can handle many users and transactions when testing financial applications. ACCELQ is capable of handling high loads. The platform’s flexibility ensures it is scalable to meet new audiences and requirements and accommodate future growth.

Integration

The financial services ecosystem is a massive web of interconnected applications and technologies. ACCELQ seamlessly integrates with various platforms, databases, and APIs in the financial services landscape. Its robust integration capabilities enable consistent and comprehensive end-to-end testing for the best automation testing results.

Industry-specific

The financial services industry has unique requirements and use cases that need special attention. ACCELQ’s pre-built test automation assets are specially tailored to Financial Services industry offerings. These industry-specific capabilities ensure seamless automation in financial services while saving testers time and effort in creating financial services-specific tests.

Design-first

Financial services systems must operate to their maximum potential 24x7 – without downtime. ACCELQ’s design-first approach makes this possible. Its business process-focused approach with built-in modularity significantly reduces maintenance. This allows testers to run automated tests repeatedly and eliminates the need to build custom frameworks from scratch.

Enterprise-ready

As an enterprise-ready test automation platform, ACCELQ is CI-ready, scalable, and secure to meet the needs of financial services organizations. The platform enables early, in-sprint automation with industry-first virtualized abstraction for seamless functional testing. This ensures financial services functionalities align with specified requirements and perform as expected.

Transform test automation in financial services with ACCELQ

Although critical, test automation in financial services comes with many challenges. The distinctive nature of financial services processes and apps creates several hurdles for QA engineers. If you want to enable seamless automation in financial services, you need to find a way to accelerate and improve the software testing process.

As a codeless, AI-powered, cloud-based test automation platform, ACCELQ offers just the right capabilities for automation in financial services. This enterprise-ready, design-first platform offers financial services-specific test automation features. Testing teams can leverage ACCELQ to enable end-to-end automation. They can comply with financial services-specific security and compliance requirements and ensure seamless scalability and integration.

Explore the differentiating capabilities of ACCELQ today for your automated financial system!

Nishan Joseph

VP Sales Engineering

Nishan is a tech strategist with expertise in Test Automation and roles at giants like TCS, Microfocus, and Parasoft. At ACCELQ, he champions Strategic Alliances, cultivating global tech partnerships. Educated at Leeds University and Symbiosis Pune, he also possesses an engineering background from Bangalore.

Discover More

Best Practices and Metrics for Successful Production Testing

Best Practices and Metrics for Successful Production Testing

Best Practices and Metrics for Successful Production Testing

Design Thinking for Testers

Design Thinking for Testers